In comparative economic development analysis, startup survival rates are a key indicator of how efficiently public funds are transformed into sustainable economic value. When benchmarked against economies where public entrepreneurship programs prioritize firm survival, productivity and scaling, the startup bankruptcy trends observed in North Macedonia between 2014 and 2025 raise important questions about the efficiency of public fund allocation and its contribution to long-term development.

561 companies that received business grants from the state in 2014 went bankrupt. An analysis of grants or non-repayable funds aimed at supporting business creation as a way to combat unemployment in North Macedonia over the past decade reveals that many of these businesses are still failing. While the figures vary from year to year, the situation in 2014 was particularly alarming, with 561 companies that had received state financial assistance for their businesses going out of operation. The reasons for these failures have not been fully analyzed, but this raises legitimate questions about what could be done better to increase the success, sustainability, and longevity of these enterprises.

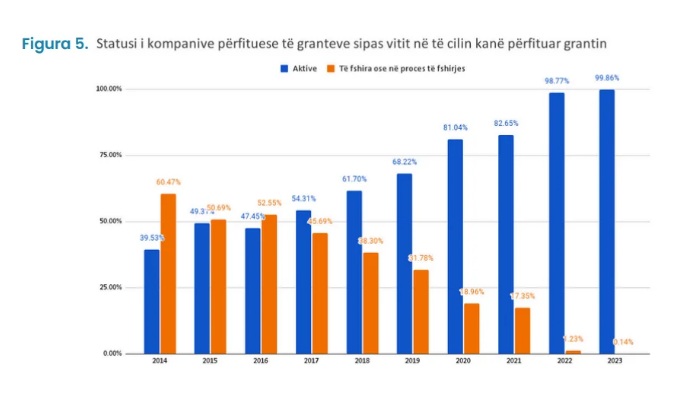

Figure 5. Status of grant beneficiary companies by year of grant allocation (%)

The figure illustrates a marked decline in startup bankruptcy rates over time, with exceptionally high failure levels among the 2014–2016 cohorts, followed by substantial improvement in later years, indicating more efficient allocation and absorption of public funds. (*Source IDEA)

Exceptionally high bankruptcy levels in 2014–2018

The most critical finding relates to the period immediately following the disbursement of public funds. By 2015, only one year after receiving grants, approximately 50.7% of supported startups had already ceased operations. The situation further deteriorated in 2016, when the bankruptcy rate rose to 52.6%, meaning that more than half of all grant-supported startups from the 2014 cohort failed within two years.

From an economic perspective, such a failure rate is extremely high and indicates that public funds were largely absorbed by startups with limited survival capacity. This suggests weaknesses not only at the business level but also in the selection, screening, and structuring of grant support mechanisms.

Early-stage bankruptcy at this scale implies that public funding was primarily effective in enabling market entry, but ineffective in supporting market survival.

Gradual Improvement Over Time (2019–2023)

A notable improvement can be observed in later years. During the 2019–2023 period, bankruptcy rates among grant-supported enterprises declined to 18.9% and 17%, respectively. This downward trend suggests that:

- Surviving firms gradually stabilized, or

- Program design and macroeconomic conditions improved over time, or

- Only the most resilient enterprises remained active, reducing the observed failure rate.

However, this improvement must be interpreted carefully. The decline in bankruptcies does not fully offset the substantial loss of public resources incurred during the early failure phase (2015–2017), when the largest share of funded startups exited the market.

Implications for the distribution of public funds

The data indicate that public funds were not optimally distributed in terms of long-term economic impact. A large portion of resources was allocated to startups operating in sectors with:

- Low entry barriers,

- High competition,

- Limited productivity growth potential, and

- Strong dependence on local demand.

As a result, grants functioned more as short-term income support mechanisms rather than as instruments for sustainable enterprise development. From an efficiency standpoint, this reduces the return on public investment and weakens the contribution of grants to structural economic transformation.

Economic interpretation

The experience of the 2014 startup cohort highlights a key structural issue: high startup creation rates do not automatically translate into sustainable entrepreneurship. When bankruptcy exceeds 50% within two years, the economic outcome is not enterprise development, but rather rapid capital erosion and limited multiplier effects.

The later improvement in bankruptcy rates demonstrates that sustainability is achievable, but only when firms pass the vulnerable early phase. This underscores the importance of better-targeted funding, improved screening of business models, and a more balanced allocation of public resources toward enterprises with higher survival and growth potential.

Lesson learned for North Macedonia

Between 2014 and 2025, the trajectory of grant-supported startups reflects a clear pattern: very high early-stage failure followed by gradual stabilization. While later improvements are encouraging, the exceptionally high bankruptcy levels in 2015–2016 indicate that the initial spread of public funds was insufficiently aligned with long-term sustainability objectives.

For public funding to generate lasting economic value, the emphasis must shift from the number of startups created to the quality, resilience and economic contribution of the enterprises supported.

Read as well: https://vox-al.com/561-kompani-qe-moren-grant-per-biznes-nga-shteti-ne-vitin-2014-falimentuan/