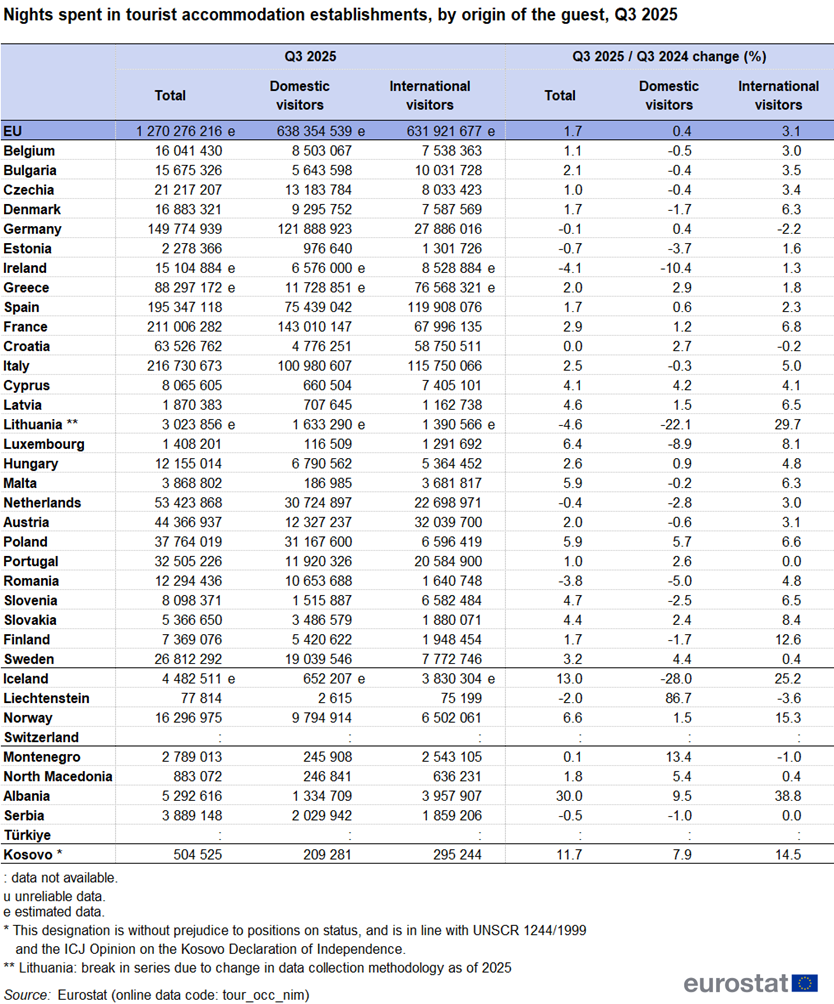

Tourism in the Western Balkans: winners, losers, and the race for growth is clearly reflected in the latest Eurostat data for the third quarter of 2025, which reveal a deeply asymmetric tourism landscape where some countries are experiencing explosive expansion while others are stagnating or even declining. These differences are not marginal, they are structural and strategic, directly shaped by policy choices, destination positioning and long-term competitiveness.

The latest regional data on tourism dynamics in the Western Balkans reveal significant shifts in tourist overnight stays and travel preferences across neighboring countries. According to recent Eurostat figures for the third quarter of 2025, Albania and Kosovo are experiencing strong growth in tourist overnight stays, positioning them as leading markets for tourism expansion in the region. Conversely, Serbia is showing a slowdown in overnight stays, indicating a comparative deceleration in tourism momentum.

For North Macedonia, this evolving regional tourism landscape presents both opportunities and challenges. While tourism continues to contribute to the national economy, the growth in overnight stays has not matched the pace recorded in Albania and Kosovo. North Macedonia boasts significant natural and cultural assets: including Lake Ohrid, national parks, and rich heritage sites , yet the country must further strengthen its tourism infrastructure, international marketing efforts, and regional cooperation to enhance competitiveness.

As an organization committed to sustainable development, ISD highlights the importance of:

Albania: The Regional Outlier and Growth Champion

Albania stands out as the undisputed tourism phenomenon of the region.

- Total nights spent: 5.29 million

- Year-on-year growth:+30.0%

- International tourist nights growth:+38.8%

- Domestic growth:+9.5%

These figures are extraordinary when placed in a European context. While the EU average growth in total nights is just +1.7%, Albania is growing at almost 18 times the EU average. The country is not merely recovering, it is repositioning itself as a major Mediterranean and Balkan destination, driven overwhelmingly by foreign demand.

Nearly 4 million international overnight stays in just one quarter underline Albania’s successful international visibility, accessibility, and pricing competitiveness.

Kosovo: Small Market, Big Momentum

As measured by the Statistical Agency of Kosovo, hotel nights by non-residents increased significantly in 2023, with non-resident overnight stays rising to 504,525. Kosovo confirms its status as a fast-growing, high-momentum destination, despite its smaller tourism base.

- Total nights spent: 504,525

- Total growth:+11.7%

- International growth:+14.5%

- Domestic growth:+7.9%

Kosovo’s growth rate is almost seven times higher than the EU average, with foreign tourist nights growing twice as fast as domestic ones. This signals rising regional and diaspora-driven demand, but also untapped potential if infrastructure and promotion improve further.

North Macedonia: Moderate growth, huge potential for international visitors

North Macedonia shows positive but restrained growth, remaining well below regional frontrunners.

- Total nights spent:883,072

- Total growth:+1.8%

- Domestic growth:+5.4%

- International growth:+0.4%

While overall growth slightly exceeds the EU average, the near-stagnation of international tourist nights (+0.4%) is a critical signal. Growth is being driven primarily by domestic tourism, not by increased international competitiveness.

In a region where Albania records +38.8% and Kosovo +14.5% international growth, North Macedonia risks falling behind in visibility, connectivity and destination branding, despite its rich natural and cultural assets.

Serbia: A tourism slowdown

Serbia’s data reflect a clear loss of momentum. Serbia recorded over 2.1 million total international arrivals in 2025, while they approximately spent 3.89 million nights.

- Total nights spent:3.89 million

- Total change:−0.5%

- Domestic change:−1.0%

- International change:0.0%

This is not growth, it isstagnation. Serbia is one of thefew countries in the region with a negative overall trend, underperforming not only compared to Albania and Kosovo, but alsobelow the EU average. The data suggestmarket saturation, weak growth drivers, or insufficient diversificationof tourism products.

Slovenia: The Strategic Benchmark

Slovenia represents a crucial reference point for the region, a country without mass coastal tourism like Albania, yet far outperforming most Western Balkan peers.

- Total nights spent: 8.10 million

- Total growth: +4.7%

- International growth: +6.5%

- Domestic change: −2.5%

Despite a decline in domestic tourism, Slovenia achieved robust overall growth driven by foreign visitors. Its international growth rate (+6.5%) is nearly four times the EU average and more than 16 times higher than North Macedonia’s (+0.4%).